In the realm of banking and financial transactions in Nigeria, the Bank Verification Number (BVN) has become a crucial element for both customers and financial institutions. As a unique identifier for bank customers, the BVN helps to enhance security, prevent fraud, and streamline banking processes. With the growing digitization of financial services, performing a BVN check has emerged as an essential practice for verifying the authenticity of bank accounts and ensuring compliance with regulatory requirements.

As the Nigerian banking sector continues to evolve, understanding the significance of a BVN check not only helps customers safeguard their finances but also empowers them with knowledge about their financial identity. By delving into the mechanics of the BVN system, we can uncover how this simple number plays a pivotal role in fostering trust and transparency in financial dealings.

In this article, we will explore various aspects of the BVN check, including its benefits, how to perform one, and common questions surrounding this vital process. Whether you are a bank customer looking to verify your BVN or a financial institution seeking to enhance your security protocols, this comprehensive guide will equip you with the necessary insights.

What is a BVN Check?

A BVN check is the process of verifying an individual's Bank Verification Number. This unique 11-digit number is issued to every bank customer in Nigeria and serves as a means of identifying and authenticating them across all banks in the country. The BVN system was established by the Central Bank of Nigeria (CBN) to curb fraudulent activities and improve the overall security of banking transactions.

Why is a BVN Check Important?

Performing a BVN check is crucial for several reasons:

- Fraud Prevention: It helps prevent identity theft and fraudulent activities.

- Account Verification: Ensures that the bank account belongs to the individual claiming it.

- Regulatory Compliance: Banks can meet regulatory requirements by conducting BVN checks.

- Streamlined Transactions: Simplifies the process of opening accounts and applying for loans.

How Can You Perform a BVN Check?

Performing a BVN check is a straightforward process that can be done in various ways:

- Through Mobile Apps: Many banks offer mobile banking applications that allow users to check their BVN.

- Online Banking: Log into your bank's online portal and navigate to the BVN verification section.

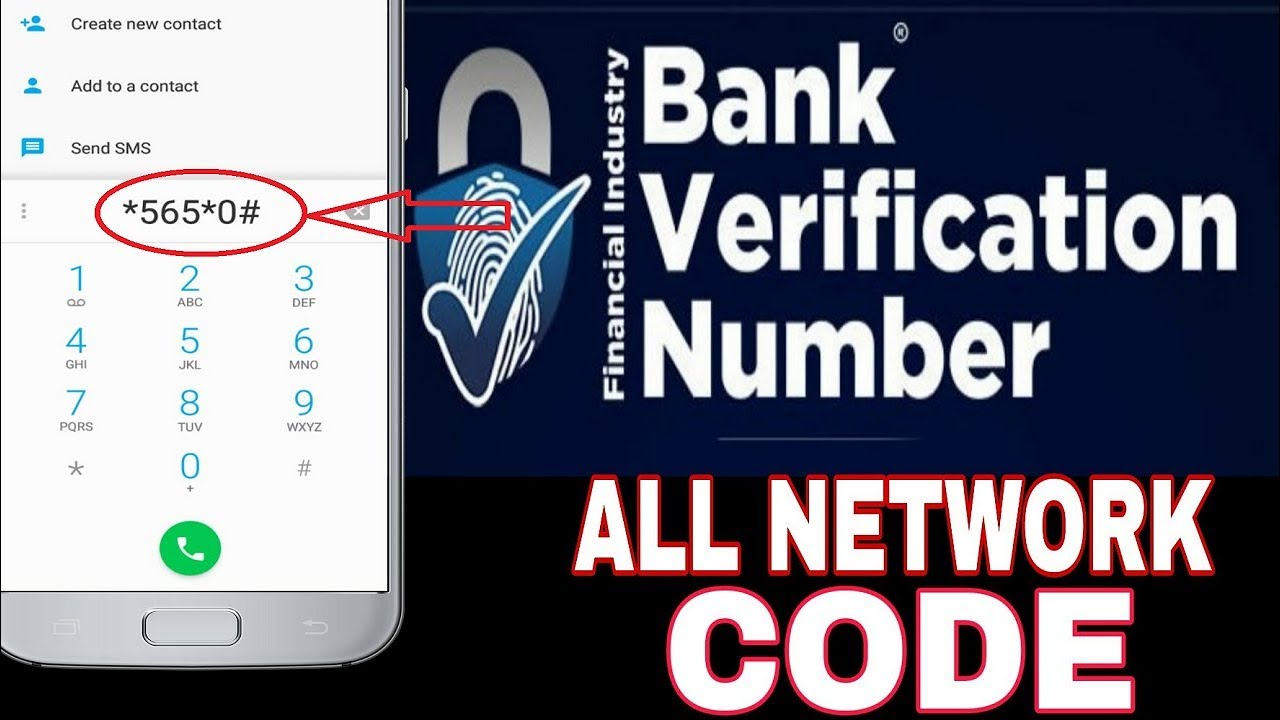

- USSD Codes: Some banks provide USSD codes to check BVN directly from your mobile phone.

- Visit a Bank Branch: You can also visit a nearby bank branch for assistance with your BVN check.

What Are the Benefits of a BVN Check?

The benefits of performing a BVN check extend beyond personal security. They include:

- Enhanced Security: Reduces the risk of unauthorized access to bank accounts.

- Improved Customer Trust: Builds confidence among customers regarding their banking relationships.

- Faster Transactions: Speeds up the verification process during transactions.

- Financial Inclusion: Facilitates access to financial services for underserved populations.

Who Needs to Conduct a BVN Check?

Various stakeholders can benefit from conducting a BVN check:

- Bank Customers: Individuals who want to verify their bank accounts.

- Financial Institutions: Banks and other financial entities to ensure due diligence.

- Loan Providers: Organizations offering loans to verify applicants' identities.

- Employers: Companies that wish to verify the bank accounts of their employees.

What Happens if You Fail a BVN Check?

If a BVN check does not match the provided information, several consequences may occur:

- Transaction Delays: You may experience delays in completing transactions.

- Loan Rejections: Applying for loans may become challenging if your BVN cannot be verified.

- Account Restrictions: Banks may place restrictions on your account until the issue is resolved.

Conclusion: The Future of BVN Checks in Nigeria

As Nigeria continues to advance in financial technology and digital banking, the role of the BVN check will only become more significant. It not only fosters a secure banking environment but also promotes financial inclusion by allowing more people to access banking services safely. Understanding how to perform a BVN check and the associated benefits is essential for anyone who engages with the Nigerian banking system. By embracing the BVN initiative, we can pave the way for a more secure and trustworthy financial landscape in Nigeria.