In today's digital financial landscape, the Bank Verification Number (BVN) has become an essential tool for securing banking transactions and personal information. This unique identifier is crucial in combating fraud and ensuring the safety of customers’ accounts. As a Nigerian citizen or resident, knowing how to check your BVN is not just important; it’s a necessity that can save you from potential banking mishaps.

The BVN system was introduced by the Central Bank of Nigeria (CBN) to create a secure banking environment. With the rise of online banking and mobile transactions, having a BVN is the key to accessing various banking services efficiently. In this article, we will explore everything you need to know about checking your BVN, why it matters, and how to ensure your banking experience is safe and secure.

As we delve into the details, you’ll learn about the methods available to check your BVN, the significance of the number, and some common issues surrounding it. By the end of this guide, you will be equipped with all the necessary information to manage your financial identity confidently.

What is a BVN?

The Bank Verification Number (BVN) is an 11-digit unique identification number issued to every bank customer in Nigeria. It serves as a means to authenticate customers' identities during banking transactions. The primary purpose of the BVN is to curb fraud and protect customers' funds from unauthorized access.

Why is it Important to Check Your BVN?

Checking your BVN is crucial for several reasons:

- Ensures that your BVN is correctly registered.

- Helps prevent identity theft.

- Enables access to banking services efficiently.

- Facilitates loan applications and other financial services.

How Can You Check Your BVN?

Checking your BVN is simple and can be done through various methods. The most common ways include:

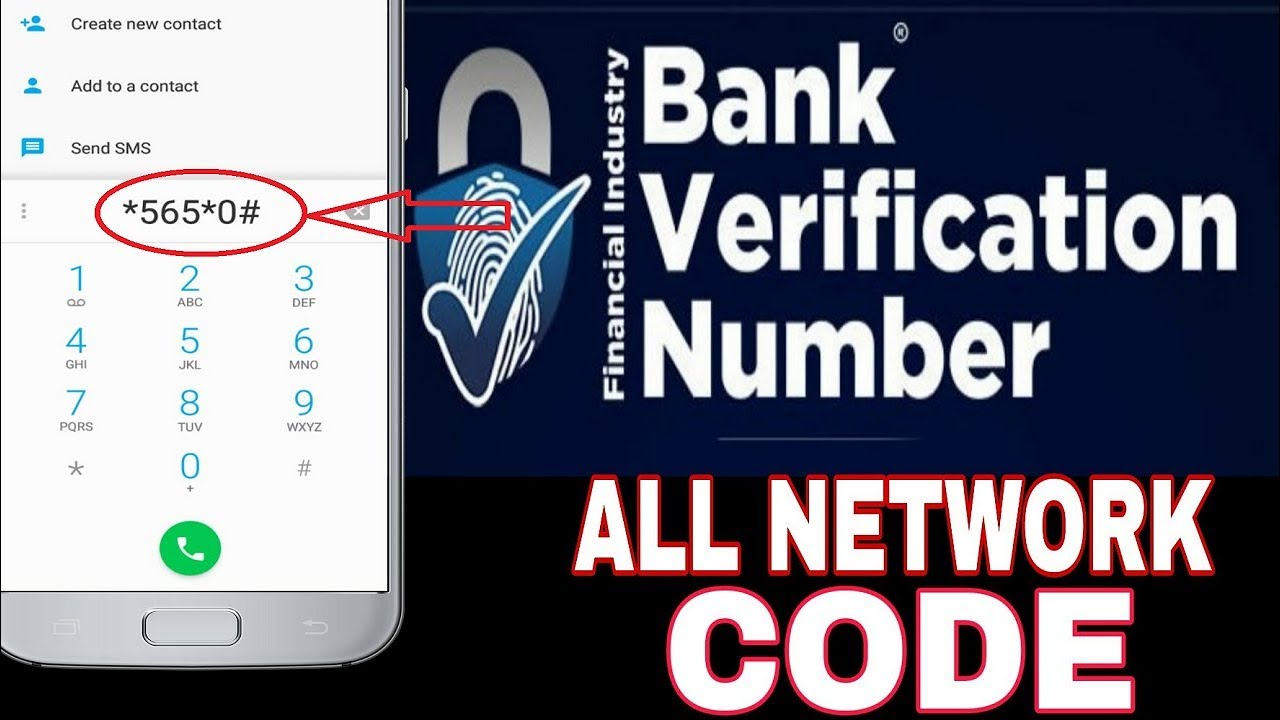

- Using a USSD code provided by your bank.

- Visiting your bank's website or mobile app.

- Calling the customer service line of your bank.

What Are the Steps to Check Your BVN Using USSD Codes?

Many banks in Nigeria allow customers to check their BVN using USSD codes. Here’s a general step-by-step guide:

- Dial the USSD code specific to your bank.

- Follow the prompts provided on the screen.

- Your BVN will be displayed on your mobile screen.

Can You Check Your BVN Online?

Yes, you can check your BVN online through your bank’s official website or mobile banking app. Here’s how:

- Log in to your bank's online platform.

- Navigate to the account settings or profile section.

- Your BVN will be displayed there for your reference.

What Should You Do If You Encounter Issues While Checking Your BVN?

If you face difficulties while trying to check your BVN, consider the following:

- Ensure you are using the correct USSD code for your bank.

- Check your network connection if using mobile services.

- Contact your bank’s customer service for assistance.

Who Needs a BVN?

Anyone who conducts banking transactions in Nigeria is required to have a BVN. This includes:

- Individuals with savings and current accounts.

- People applying for loans or credit facilities.

- Those engaging in mobile banking activities.

Can You Have Multiple BVNs?

No, it is illegal to have more than one BVN. The BVN is designed to be unique to each individual, and having multiple BVNs can lead to complications and potential legal issues.

What to Do If You Forget Your BVN?

If you forget your BVN, you can retrieve it through the following methods:

- Dial your bank’s USSD code for BVN retrieval.

- Visit your bank branch with valid identification.

- Contact customer service for assistance.

Conclusion: Keeping Your BVN Safe

In conclusion, regularly checking your BVN is vital for maintaining the security of your banking transactions. Understanding how to check your BVN will not only protect you from fraud but also ensure that you can access all banking services without any hitches. Always keep your BVN confidential and report any suspicious activity immediately to your bank. With this knowledge, you can navigate the financial landscape confidently and securely.